KUALA LUMPUR, Oct 7 — The Association of E-Money Issuer (AEMI) has proposed the government consider extending the current sales and service tax (SST) exemption for digital financial services in Budget 2025 to sustain the industry’s growth.

AEMI said the extension is also important for promoting the wider adoption of cashless payments, which aligns with Malaysia’s efforts to build an inclusive and progressive financial system.

“The association recognises the government’s efforts to broaden the tax base for national development and trusts that these initiatives will continue to support the expansion of cashless services.

“The current SST exemption has been crucial in making digital financial services more affordable, particularly for underserved communities, and AEMI is hopeful that an extension of this exemption will further foster digital inclusion,” it said in a statement.

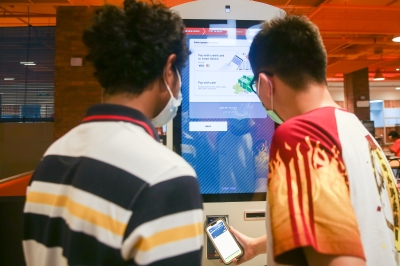

The association noted that the e-wallet industry has been instrumental in advancing financial inclusion and digital transformation in Malaysia. It said AEMI members have played a pivotal role in delivering digital financial services to a diverse user base, including the B40 and M40 groups and micro, small and medium-sized enterprises (SMEs).

“These segments are integral to the nation’s economy and stand to benefit significantly from accessible cashless services. To sustain this momentum and ensure the widest possible access to digital financial solutions, AEMI believes that it is essential to maintain policies that promote growth and inclusivity,” it added. — Bernama