SINGAPORE – The police have issued 121 prohibition of disposal orders against vehicles registered under SRS Auto amid a multi-agency probe into possible money laundering activities in the car leasing business.

The order blocks the sale and transfer of vehicles owned by the car leasing firm.

Investigations had started in 2024, after police received financial intelligence from the Suspicious Transaction Reporting Office regarding

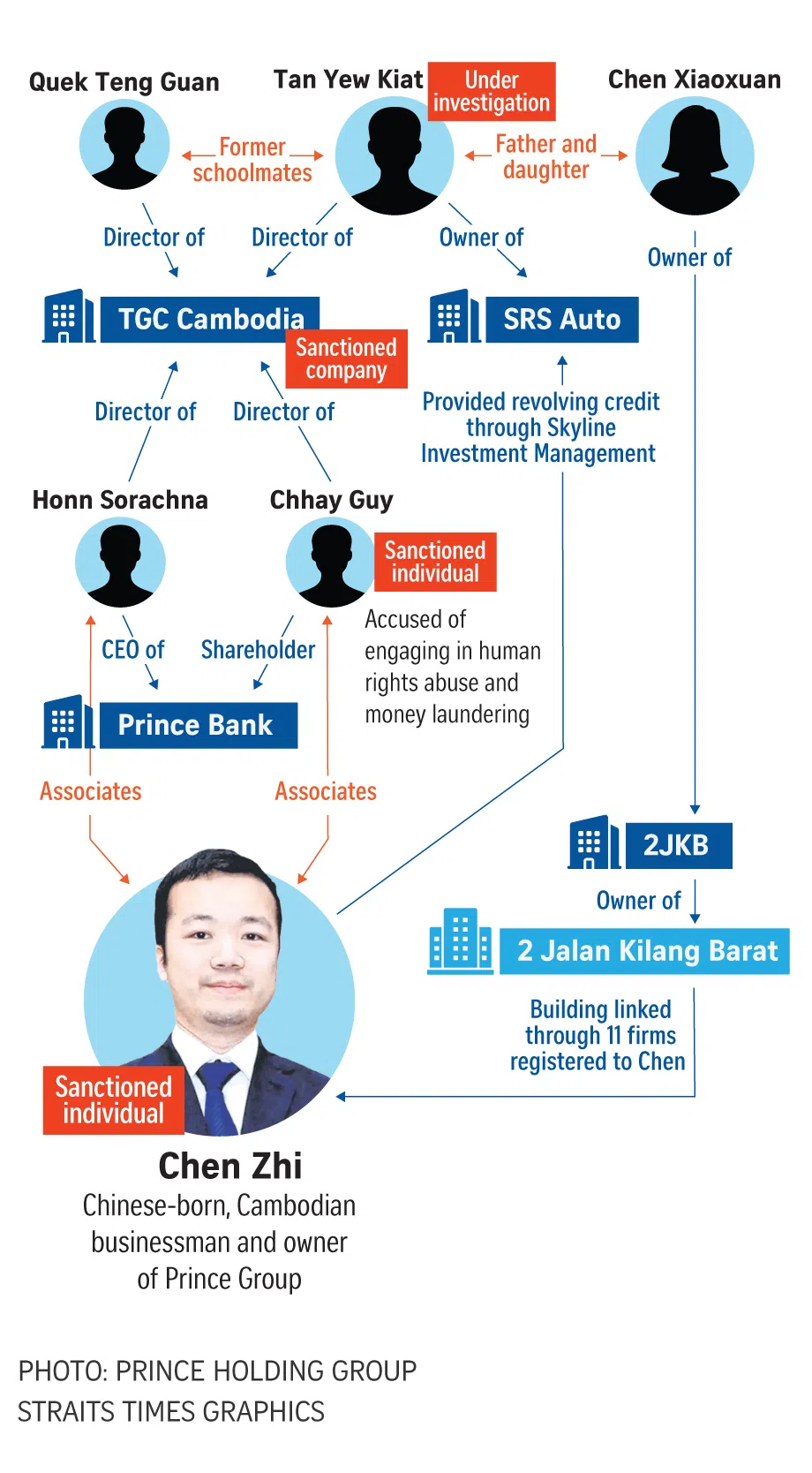

Cambodian businessman Chen Zhi and his associates

.

The 38-year-old tycoon, who chairs real estate and financial services conglomerate Prince Group, was later indicted in the US on Oct 14, 2025, over alleged wire fraud and money laundering conspiracy, and for allegedly directing the operation of forced-labour scam compounds in Cambodia.

The

probe in Singapore

involves the police and member agencies of the Anti-Money Laundering Case Coordination and Collaboration Network, including the Monetary Authority of Singapore (MAS) and intelligence agencies.

The Straits Times understands that police investigators are speaking to a number of industry insiders, including Ms Chen Xiaoxuan.

Ms Chen is the daughter of

Mr Tan Yew Kiat

, the owner of SRS Auto. Mr Tan was arrested following a raid at his firm’s office in Kung Chong Road in late November.

The 49-year-old was arrested for his suspected involvement in money laundering services.

SRS Auto owner Tan Yew Kiat was arrested following a raid at his firm’s office in Kung Chong Road in late November.

PHOTO: ST FILE

Ms Chen, who is assisting police with their investigations, is listed as a director of Supreme Cars Financial Services, Rolls Platform, and Cars and Coffee Leasing.

They are all registered to a commercial property at

2 Jalan Kilang Barat

, which Ms Chen owns through her fourth company, 2JKB.

Mr Tan and Ms Chen previously had links to two other firms in the auto trade – Supreme Cars Financial Services and SRS Auto Capital.

Chen Zhi appears to be the central figure in the probe.

The authorities are looking into his many business interests in Singapore, investments in sectors such as the auto trade, and individuals he had dealings with.

ST previously reported that the commercial property also known as 2 Jalan Kilang Barat is directly linked to 11 Singapore-based companies owned by Chen Zhi, and another three linked to his close adviser Chen Xiuling, or Karen Chen.

Located in the Bukit Merah vicinity, the property at 2 Jalan Kilang Barat was put up for sale for $50 million on Dec 2.

PHOTO: SHIN MIN DAILY NEWS

Mr Tan and his close associate and former schoolmate Quek Teng Guan are also directly linked to Chen Zhi.

The Singaporeans were directors in TGC Cambodia, a “pawnshop” in Phnom Penh chaired by a shadowy individual named Chhay Guy, who was sanctioned by the US Treasury along with Chen Zhi for their alleged ties to online scams and money laundering.

Motor vehicle loans granted by financial institutions must abide by the MAS’ motor vehicle financing restrictions, which place limits on the amount of loans that can be given out.

The maximum loan-to-value limit is based on the vehicle’s open market value (OMV). For cars with an OMV above $20,000, the loan is capped at 60 per cent of the purchase price, while for those with an OMV below or equal to $20,000, the cap is 70 per cent.

Car leasing companies are known to offer lease-to-own schemes that fall outside of MAS regulations.

These schemes include unsecured personal loans, with higher interest rates, that can account for 100 per cent of the value of the car.

In a reply to a parliamentary question in October, Acting Minister for Transport Jeffrey Siow said that such alternative financing arrangements extended by car dealers are not regulated by MAS.

“Buyers are strongly advised to obtain loans through regulated arrangements instead of unregulated ones, as they will have no protection if there are problems with the loan arrangements,” he added.

Industry insiders had previously sounded a note of caution over the rampant use of such financial arrangements by vehicle owners who register their cars as private-hire or corporate vehicles.

Used-car marketplace Carro previously revealed that up to eight in 10 of its customers had registered their cars this way to secure a loan of up to 100 per cent of the vehicle’s cost.

According to Land Transport Authority figures, the number of chauffeured private-hire cars surged from 614 to 46,477 between 2013 and 2022, while the pool of privately owned cars fell from 582,296 to 542,145.

A spokesperson for MAS told ST that although the regulatory body does not regulate vehicle leasing companies, Singapore’s anti-money laundering laws apply whether or not an entity is licensed and regulated.

INSEAD’s associate professor of finance Ben Charoenwong said motor vehicle financing is governed by the Ministry of Law for licensed moneylenders, under the Hire-Purchase Act for hire-purchase arrangements, and by MAS for financial institutions.

In-house financing provided by car leasing companies falls outside of the regulatory environment.

Prof Charoenwong said: “Regulated financial institutions must actively prevent and report – conducting know-your-customer (checks), monitoring transactions, and filing suspicious activity transaction reports.

“Car leasing firms face no such preventive requirements. They are liable only if caught laundering.”

He said the lack of regulatory oversight presents structural weaknesses that could be exploited.

“When a car leasing firm receives a ‘business loan’ from an offshore entity, the firm’s bank sees incoming funds with commercial documentation.

“The bank cannot easily verify whether the offshore source is legitimate,” said Prof Charoenwong.

This is one area currently being looked at in the car leasing probe.

SRS Auto was found to have taken an unspecified loan involving an undisclosed sum from Chen Zhi’s sanctioned Singapore investment vehicle – Skyline Investment Management – some time in May 2017.

Prof Charoenwong noted that the source of funds in SRS Auto’s case was uncovered only years later.

“Why would a Cambodia-linked entity provide revolving credit to a Singapore car lessor?

“The absence of a coherent commercial rationale should itself be a red flag,” he said.

Singapore University of Social Sciences transport economist Walter Theseira said current arrangements that limit vehicle financing are intended to promote consumer prudence and manage risk for financial institutions.

He added that a secondary objective is that they also help to manage “COE (certificate of entitlement) market froth”.

However, these arrangements are rendered ineffective for consumers willing to take the risk of unregulated loan arrangements.

Prof Charoenwong said there are no easy fixes.

“Regulators have several options, but it is also not immediately obvious the response to the scandal should be more regulation.

“Better enforcement of existing rules – sure, but we don’t necessarily need much heavier-handed solutions,” he said, adding that tightening car leasing may push money launderers to other high-value assets, including boats, watches and art.

“Global shadow banking assets grew from US$28 trillion (from 2009) to US$63 trillion (S$81.6 trillion) by 2022. The same dynamic applies here. Bad actors don’t disappear when disciplined. They migrate,” he added.

A police spokesperson said car dealers who have financed vehicles through SRS Auto can submit documentation to sell or redeem these loans.

“SPF (Singapore Police Force) will verify and assess the requests on a case-by-case basis. SPF will also seize any loan redemption amounts that are payable to SRS Auto,” the police added.

A loan redemption refers to the settlement of the outstanding loan, which would include both the principal sum borrowed and interest collected.

A car dealer ST contacted said he was informed that cars he had purchased through SRS Auto’s financing have not been blocked.

Mr Ng Lee Kwang, managing director at Octagon Motors Group, said he had taken a loan of around $80,000 from SRS Auto to fund the purchase of a Kia Cerato and Honda City to resell them.

He was informed by SRS Auto in late November that the loans for the two cars are not subject to any restrictions, so he can sell the cars and redeem the loans.

This is known as a floor stock loan, which is a form of short-term financing that motor dealers like Octagon Motors Group use to buy cars for reselling. Such loans are typically given in three-month blocks. Motor dealers have to repay the sum owed before they can transfer ownership of the car to the next buyer.

-

Additional reporting by Lee Nian Tjoe