SINGAPORE – Patients must be notified, and their explicit consent sought, before any of their health information can be sent by their doctors to private insurers for insurance purposes.

Also, only information that is necessary and relevant to patients’ insurance claims or underwriting assessment can be shared with insurers. This applies even if doctors are bound by contractual terms that seek to grant insurers the right to inspect and audit patients’ medical records.

These reminders from the Ministry of Health (MOH)

came after the passage

of new legislation in Parliament on Jan 12

.

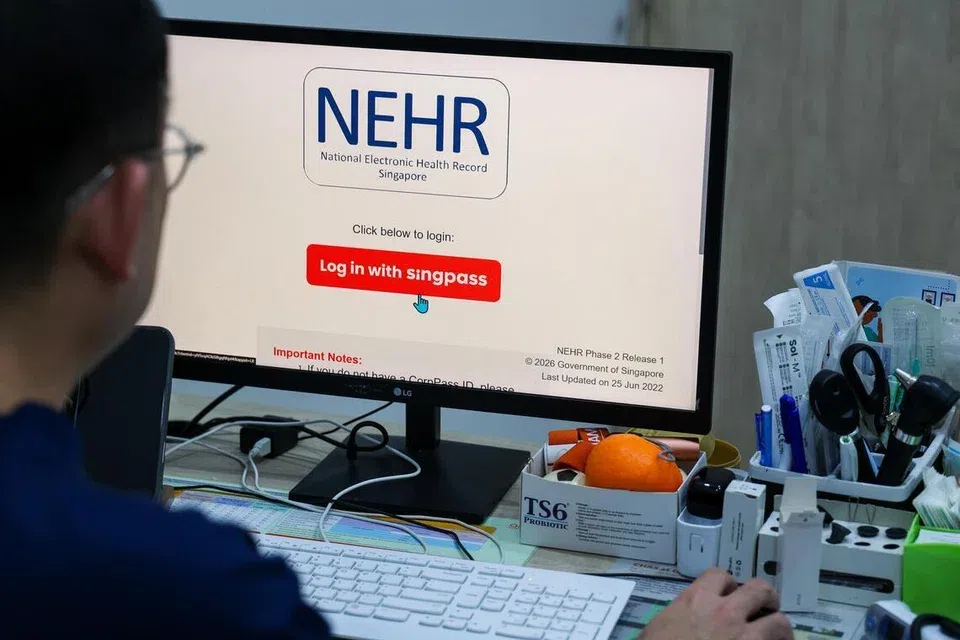

The Health Information Act, which is expected to take effect in early 2027, will require all healthcare providers to contribute patients’ key health information to the national repository, the National Electronic Health Record (NEHR) system.

In response to queries from The Straits Times, MOH said it issued a circular on Jan 9 to reiterate that access to NEHR for insurance purposes “is strictly prohibited and an offence”.

Under the new law, those convicted of unauthorised access to NEHR information for excluded purposes, such as for insurance matters, will face a fine of up to $100,000 and/or up to four years’ imprisonment for their first offence.

The circular was sent to registered medical and dental practitioners, as well as licensees under the Healthcare Services Act (HCSA), which includes all hospitals and nursing homes.

In its reply to ST, MOH added that insurers do not have access to NEHR, as it is restricted to those providing patient care.

Insurers are also prohibited from asking or requiring others to access NEHR on their behalf.

Currently, on a case-by-case basis, insurers may request medical information from practitioners to process patients’ claims or for underwriting purposes.

This may include verifying a diagnosis and treatment, ascertaining if a claim is payable or confirming an applicant’s medical history or signs and symptoms to assess underwriting risk.

MOH said in Parliament on Jan 12 that providers and professionals should prepare separate reports, memos or clinical summaries for insurers, instead of providing patients’ raw medical records, which may contain extensive information, possibly including irrelevant details.

If a doctor had referred to NEHR for information and verified it with the patient as part of medical history-taking, such information might be captured in the doctor’s own medical records, together with a clinical assessment.

In such cases, MOH said providers would need to carefully assess which information in these records would be relevant and necessary to be provided to insurers.

In its reply to ST, the ministry said it also issued a guidance note on Jan 9 to the Life Insurance Association (LIA), the General Insurance Association of Singapore, and all seven Integrated Shield Plan (IP) insurers.

Specifically, it reminded insurers of the appropriate practices and scope when requesting patients’ medical records.

Insurers must also ensure that contractual agreements do not compromise panel doctors’ ability to comply with their legal obligations under HCSA and the new law passed on Jan 12, as well as their professional ethical code and guidelines.

These legal and ethical obligations pertain to maintaining patient confidentiality and protecting patient records.

MOH further urged insurers to review and, if necessary, revise any existing contract clauses with panel doctors to ensure adherence to appropriate practices.

Discussion on these contractual clauses first surfaced online in end-2025, when it was revealed that panel doctors of an unnamed IP insurer had been asked to sign a new contract following the removal of a third-party administrator managing the doctors.

The new contract included an “inspection and right to audit” clause, which allows the insurer and its authorised personnel, such as external auditors, to inspect, examine, and audit the doctors’ operations and medical records, “including, but not limited to, the patient’s case sheet, treatment plan, and/or dispensing record”.

Doubts were raised about whether insurers would then have access to information that inadvertently reveals other medical conditions or past procedures not related to the claims, and if such information might affect their decision to cover the person or the level of underwriting risk they would assume.

In the MOH circular seen by ST, the ministry highlighted that even with such clauses, “insurers should not be given access to the raw medical records, regardless of whether they are in digital or physical format”.

Singapore Medical Association (SMA) president Ng Chee Kwan told ST that apart from providing medical reports to insurers with patients’ consent, panel doctors might be contractually required to grant insurers the right to inspect patients’ medical records, typically for audit purposes.

He said that although these audit clauses are common, “as far as we know, actual audit requests are uncommon”.

SMA represents the majority of medical practitioners in the public and private sectors.

Dr Ng added that despite the time and effort required to prepare separate medical reports for insurers, doctors would still prefer to do so rather than share their notes, to uphold confidentiality.

Echoing the circular, he said SMA recommends that insurers amend their audit clauses “to be compliant with the guidance from MOH”.

Mr Chan Wai Kit, LIA’s executive director, said life insurers request medical information from health providers on a case-by-case basis for claims and underwriting purposes, “only with explicit customer consent and where necessary”.

LIA is the trade association for life insurance product providers and life reinsurance providers.

He pointed out that requesting information for purposes such as verifying a diagnosis and treatment, ascertaining if a claim is payable, or confirming an applicant’s medical history, conditions and symptoms is part of regular operations.

LIA is aware of “right to inspect and audit” contractual clauses that could help insurers ascertain if providers have been keeping to mutually agreed contractual terms, which include the scope of agreed services, service standards, expected turnaround times and agreed rates.

These clauses would be invoked only in exceptional circumstances, such as if there are significant and potentially repeated concerns related to a provider’s non-adherence, said Mr Chan.

Doctors on IP panels are contracted to charge within a range of fees to help manage costs. Insurers encourage policyholders to seek care from panel doctors, including through additional benefits like pre-authorisation of claims and lower co-payment.

MOH said that in such exceptional circumstances, redacted copies of raw medical records may be provided, but they should also contain only information relevant to the claim.

“We assure policyholders that guard rails are already in place to ensure personal information is and will not be accessed and used without their express consent,” reiterated Mr Chan.

Safeguarding health information and ensuring its proper access and storage

was one of the key concerns raised during the debate on the Health Information Bill in Parliament.

Health Minister Ong Ye Kung said in a Jan 20 Facebook post that he gained invaluable insights on patient data-sharing policies from his foreign counterparts, whom he made a point of meeting at international meetings.

He learnt that while every country wants to better share patient data and improve care, many are not technically ready as they lack a national repository of patient data, unlike Singapore, which has NEHR.

He also received advice from regions such as Scandinavia and the Baltics that Singapore should avoid a system “to proactively seek patient consent for data sharing”.

Hence, sharing of health information among licensed healthcare providers was made the default here, with an option for those who prefer restricted access.

The new legislation was almost eight years in the making. With it finally passed, Mr Ong said this allows his ministry to move on “to try to make healthcare as seamless and integrated as possible”.