- Tax refund delays hurting cash flow: Many businesses wait over a year — some more than two — to recover overpaid taxes.

- Calls for tax system reform: ACCCIM urges faster refunds while acknowledging recent government relief measures.

- Cautious optimism ahead: Business sentiment is improving for 1H 2026 despite cost and competition worries.

KUALA LUMPUR, Jan 16 — Prolonged delays in tax refunds was among the main concerns of Malaysian Chinese businesses for 2025 and this year, with a significant number of respondents claiming they have to wait for over two years to recover overpaid taxes.

According to the latest survey by the Associated Chinese Chambers of Commerce and Industry of Malaysia (ACCCIM), 22.9 per cent of respondents reported tax refund delays exceeding 24 months.

Another 20.6 per cent have been waiting between 13 and 24 months, while 22.3 per cent reported delays of 7 to 12 months.

Over 76 per cent of businesses said an acceptable maximum duration for overpaid tax refunds should be within three months.

ACCCIM president, Datuk Ng Yih Pyng, suggested that the Inland Revenue Board (LHDN) should look toward regional peers to modernise Malaysia’s tax refund architecture.

“In designing Malaysia’s tax refunds, the Inland Revenue Department can consider drawing inferences from some regional countries’ practices,” he said at a press conference here.

Potential improvements include shorter refund timelines or hard deadlines for processing, automatic compensation and interest paid to businesses for delayed refunds, and a more flexible estimation system that would allow accurate real-time tax assessments to prevent overpayment.

But Ng also lauded the Anwar government’s fiscal policies, describing them as helpful.

He praised the reduction in service tax rate to 6 per cent on rental services, a higher threshold exemption for service tax on rental, a one-year transition period without penalty on the e-invoice implementation for a company with annual turnover between RM1 million and RM5 million.

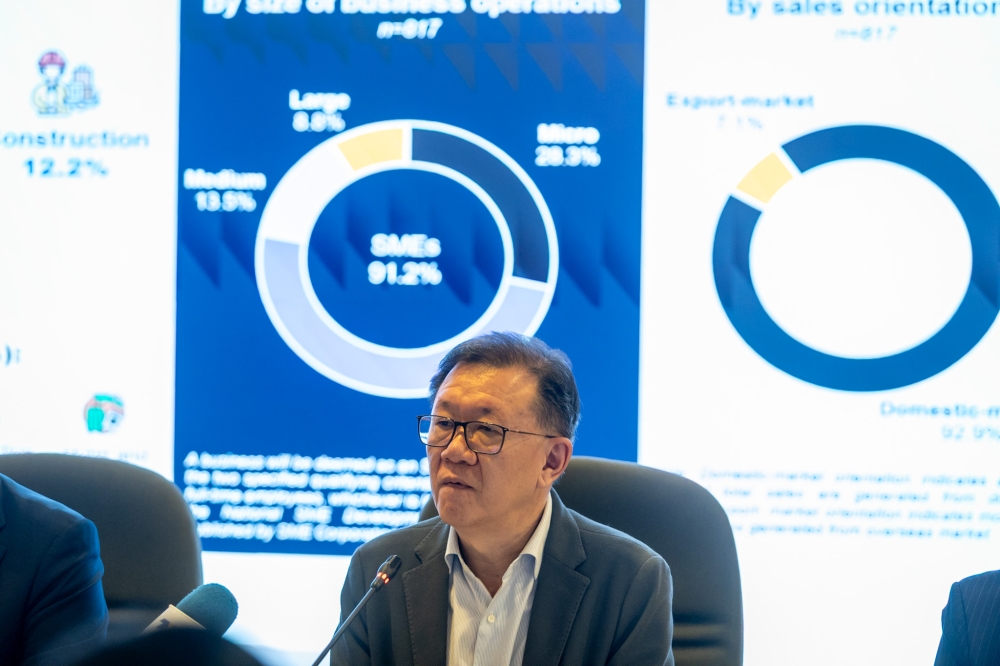

Socio-Economic Research Centre executive director Lee Heng Guie speaks during a press conference at Wisma Chinese Chamber, in Kuala Lumpur on January 15, 2026. — Picture by Firdaus Latif

The ACCCIM also thanked Prime Minister Datuk Seri Anwar Ibrahim for his personal assurance to expedite overpaid tax refunds.

“I think this is a relief for many,” said Lee Heng Guie, executive director of the Socio-Economic Research Centre (SERC), a think tank attached to the chamber.

1H 2026 outlook: Cautious optimism

Despite liquidity concerns caused by tax delays, the Malaysia’s Business and Economic Conditions Survey (M-BECS) revealed a shift toward “cautious positive sentiments” for the first half of 2026.

ACCCIM said the survey indicated expectations that sentiment improved following a cooling period in late 2025, an uplift driven by supportive fiscal policies announced in the Budget 2026, lower interest rates helping to offset rising business costs and the gradual easing of global tariff policy uncertainty.

Ng lauded the government’s recent recalibration of regulatory measures as a “partial relief” to the SME sector:

“These measures directly improve cash flow. The freed-up capital can be used to manage daily operations, pay down debt, or invest in future growth during this period of recovery,” he said.

Still, the chamber said many respondents expressed some concerns over purported rising operating costs.

“Businesses remain cautiously optimistic about economic prospects and business conditions in 1H 2026 and 2026,” Ng said.

“Businesses, especially small and medium enterprises, remain wary about increasing business costs and competition from foreign players in domestic market amid lingering uncertainties about external environment and geopolitical risks.”

The survey polled 817 businesses between December 2025 and January 2026.