Mr Louis Chua, a Member of Parliament (MP) for Sengkang GRC, suggested that “ethical lending practices” should be encouraged, apart from raising awareness of the dangers of illicit borrowing.

Strict regulations on all forms of lending, even from licensed moneylenders and banks, to prevent “exorbitant interest rates” and “highly misleading” charges should also be encouraged to protect borrowers, he added.

“Beyond that, we should also establish stronger support systems for those in financial distress, offering a range of services from counselling to emergency financial assistance and even debt restructuring programmes,” said Mr Chua.

Mr Lim Biow Chuan, MP for Mountbatten SMC, pointed to the various agencies that people can turn to.

“Those who are from low-income backgrounds should also know that there are different available to assist them with their finances, for example, from Social Service Offices and Comcare,” he said.

On the issue of young runners, Mr Melvin Yong, MP for Radin Mas SMC, said that during his time as a police officer, he had come across many cases of unlicensed money lending and saw the impact it had on those involved, including youths recruited by loan sharks.

This motivated him to create the bi-annual youth engagement programme, Delta League, in 2011, to engage youths through football and keep them “meaningfully occupied” during the school holidays.

While illegal moneylending may seem impossible to eradicate, the question then is whether the same can be said of harassment of borrowers.

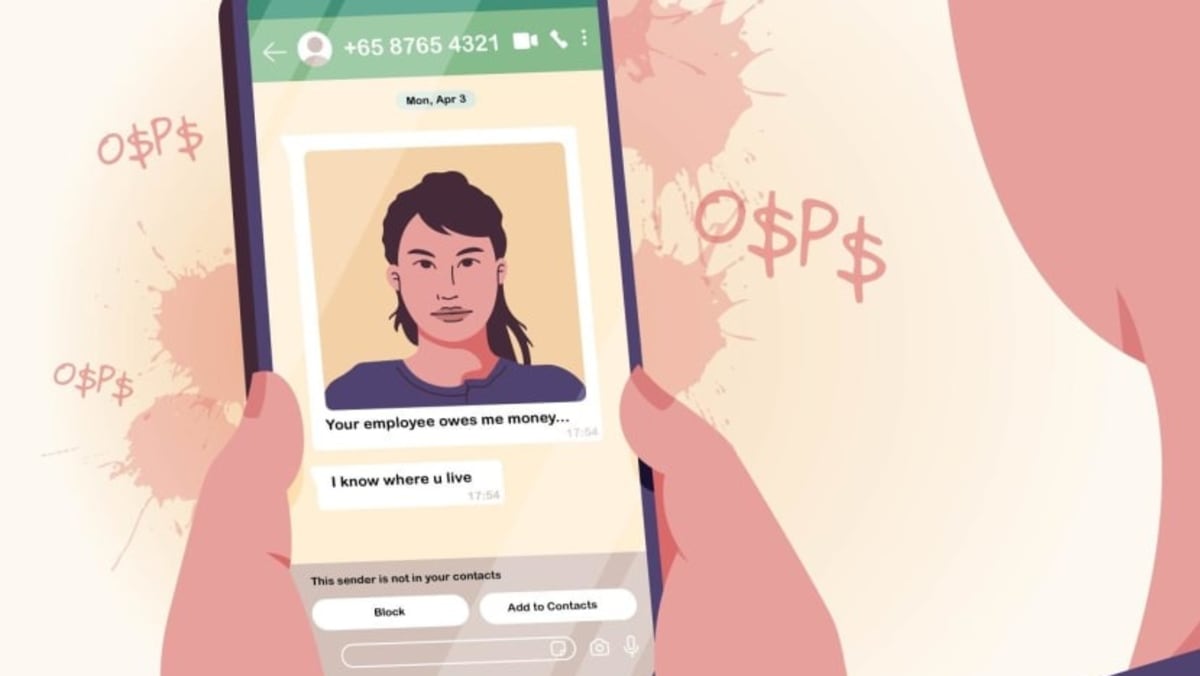

Ms James noted that as many unlicensed moneylenders may be based overseas, it has become “trickier” for local authorities to catch them.

Agreeing, Mr Vaswani noted that unlicensed moneylending is a criminal enterprise that is “borderless”, as the masterminds can “easily tap” people in Singapore to conduct harassment or lending of their personal bank accounts no matter where they are based.

“We need to address the root of the problem – which is why do people have to borrow from such sources in the first place? Are people doing so to feed an addiction?

“Or is it to feed their family, in which case the other question to ask is, ‘were there no other alternatives?’ Theoretically, if you strip away the need to borrow from such sources you will slowly dismantle the unlicensed moneylending industry,” he said.

Lawyers also noted that victims of loan-shark harassment are often caught in a “double bind”, given that borrowing from such lenders is also illegal.

“They might fear getting in trouble themselves if they report the activity. As a result, even if they do come forward, they might be hesitant to provide the full details of the situation, hindering prosecution efforts,” said Ms James.

“This lack of cooperation, stemming from a well-founded fear of violence and potential legal repercussions, makes it significantly harder to build strong cases against the lenders.”

Still, lawyers said that cracking down on runners and illegal local lenders can curb the harassment problem.

“Law enforcement can still put pressure on the unlicensed moneylender and their operations by taking strict action against the runners and local lenders, as well as seizing assets,” said Ms James.

Mr Vaswani emphasised that the ubiquity of police cameras in housing estates has also gone a long way in the identification and tracing of suspects involved in loan shark harassment, and the freezing of bank accounts used for unlicensed moneylending activities can greatly hamper illegal moneylending operations.

At the end of the day, reducing inequality is key to ending the “Ah Long” problem, said Assoc Prof Razwana.

“As long as inequality exists, we will not be able to completely eradicate unlicensed money lenders. However, we could try to minimise the dependency and make it harder for them to operate.”

This article was originally published in TODAY.